Your credit score will determine your loan eligibility with most car financiers.

It is not the only factor to pass before an approval, but it’s needed to get your foot in the door and eyes on your application.

By proactively taking steps to improve your credit score in the months leading up to your application you are maximising your chance of securing the best rate possible.

If you ignore this, you risk a rejected application and further damage being done to your credit file.

In this article, we will discuss what steps you can take today to improve your credit score before you apply for a car loan.

Key Takeaways: Improving Your Credit Score

| Do You Need a Higher Score? | A high credit score is a by-product of sound financial management. Pay your debts on time, and minimise consumer debt, and your score will improve. |

| Credit Card Utilisation | Maxed out credit cards are a high risk signal, even if you never reach your credit limit. Paying down your balance can improve your credit score. |

| New Loan Applications | Every new application can temporarily reduce your credit score. You can use a broker to pre-qualify your application with no impact on your credit file. |

| Impact of Defaults | Repay the default ASAP to start repairing your credit score. Over time your car finance options will increase. |

Find Your Current Credit Score

While there are multiple credit bureaus in Australia running multiple credit reporting systems, the most common score used by auto finance companies is the Equifax CCR score.

You can get your current credit score for free if you want to register on their site.

If your score is over 650 then you can already access some excellent finance options.

Below this, there is room for improvement, but still a lot of viable ways to obtain car finance.

If you would like an obligation free consultation for your options today then get in touch with the team below.

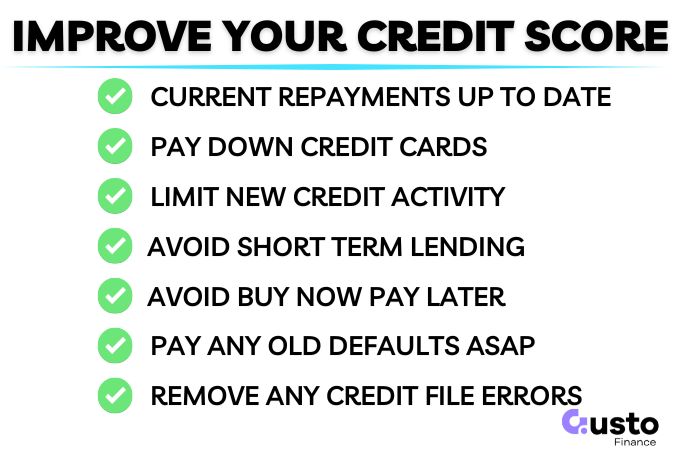

7 Ways to Improve Your Credit Score

Anyone can improve their credit score over time by keeping up to date with the repayments on any outstanding debt and avoiding unnecessary consumer credit.

However, you may not realise everything that could contribute to movements in your credit score.

Not every item below will apply to your situation, but even one can make a difference if you modify your financial habits to improve the outcome.

1. Current Repayment History

Your Comprehensive Credit Reporting (CCR) will show the current status of your debts, and the last two years of repayment history.

If you have missed a payment in the past it may show here depending on how long it took to catch up.

While you can’t change the past, ensuring that every account is up to date now will help your chances of getting finance.

Every on time payment can improve your credit score over time.

If you are not already setup with automated repayments for all of your debts you should do so immediately to remove the risk of human error.

2. Pay Down Credit Cards

The amount of credit you have used on your credit cards is also visible to lenders.

Your level of credit utilisation can influence your credit score, with consistently low utilisation being a positive factor.

High revolving balances can be an indicator of financial stress. As you pay down the outstanding balance you may see your credit score start to increase.

There are two elements that you can improve with any revolving credit balance:

- Paying down the balance before the statement date. This ensures a lower balance is reported to the bureau.

- As you pay down the balance you can also reduce your credit limits to further de-risk your position.

3. Limit New Credit Activity

Every finance application records a hard enquiry on your credit file and can temporarily reduce your credit score.

Multiple applications in a short period of time can do serious damage.

Your best chance of improving your credit score is to avoid any new finance applications.

When you are ready to explore your car finance options then if you go through a broker they can conduct a soft credit check which does affect your credit score.

This saves the hard check for when a formal application is submitted, with much more certainty of the outcome.

4. No Short Term Cash Lending

Any use of payday lending, or closely related forms of cash lending, can hurt your car loan application on multiple fronts:

- It can hurt your credit score.

- You could be instantly ineligible with some lenders, regardless of score.

If you have any current debts with these lenders then you should repay them immediately and keep a record that the account has been closed.

If you have multiple recent applications you may have to wait a few months for you to become eligible again.

The high cost, and short term nature of this type of loan product can indicate you are a high risk borrower and will limit the number of options available to you.

So, avoid any further activity around these lenders to protect your credit score prior to applying for a car loan.

5. Buy Now Pay Later Activity

Buy Now Pay Later (BNPL) applications were invisible to lenders until mandatory credit checks were introduced for this type of product.

The Low Cost Credit legislation was brought in from June 2025 and requires lender to make a credit enquiry before approving an application.

So your lenders will see this on your credit file and overuse can hurt your credit score.

Avoid any new facilities to protect your credit score, and pay down any outstanding balances prior to submitting your application for vehicle finance.

6. Pay Any Defaults

If you have previously defaulted on a payment obligation, your credit file could be marked with a default listing.

This will hurt your credit score and remain on your credit report for five years.

However, the status of the default will be updated when it is paid. The sooner you can do this the faster your credit score will improve.

Some lenders will consider applications with a newly paid default. Over time you are eligible with more lenders.

7. Audit Your Credit Report for Errors

Any negative detractors on your credit report that was listed in error could give you an immediate bump to your credit score.

These systems are complex and sometimes events can be allocated to the wrong individual.

Sometimes there are also cases of fraud and identity theft that you may not even know about!

Scan your report immediately for any incorrect personal details, duplicate enquiries, settled debts listed as unpaid, or incorrect defaults.

If you find any errors you can take the following action:

- Contact the Provider: Raise the issue with the credit provider first to request correction or removal.

- Lodge a Dispute: If unresolved, dispute the listing directly with the credit reporting body (e.g., Equifax).

- Escalate: Take the matter to the Australian Financial Complaints Authority (AFCA) or OAIC if they refuse to act.

Successfully removing these errors is one of the few ways to improve your credit file quickly.

Frequently Asked Questions

How long does it take to improve a credit score?

Quick improvements are possible depending on the starting position of the score, and what the current detractors are. Easier improvements like paying down high credit card balances, and reducing credit limits, can boost your score in as little as 30 to 45 days. More serious negative events like a default, can take much longer.

Is a good credit score enough to get approved for a car loan?

Your credit file is only one part of the assessment. Lenders review your income and expenses to determine if you can afford to repay the loan, your requirements and objectives, and assess the vehicle are buying before final approval

Should I improve my credit score before applying for a car loan?

The higher your credit score the more options you have when finding the best lender for your credit profile. If you have a low credit score, you may still be able to get a loan from specialist bad credit lenders but they will be costly and you may benefit from increasing your score first.

Improve Your Credit Score and Get Approved

You can generally improve your credit score through prudent management of your finances and developing an impeccable track record of debt reduction and contract adherence.

If you have had credit problems in the past, you just need to get on the right track and give it time.

You may be surprised how quickly your credit score can recover, and how soon you will be eligible for a car loan.

If you are unsure whether your credit score is high enough, then get in touch with our expert team of brokers who can make an assessment in minutes.

They can also protect your credit score by only submitting an application where there is a high chance of approval.