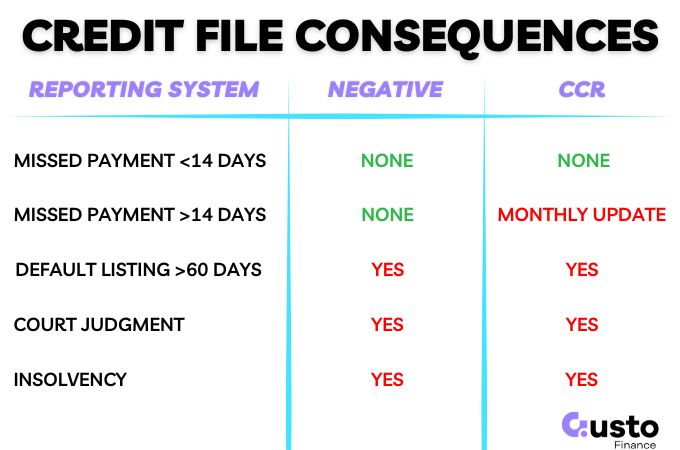

If you have missed a repayment, then you have a small window of time to make this up before it will be visible on your credit file.

As long as you do so within 14 days, then no long-term harm has been done. Beyond this, there are various levels of credit events that can be reported.

In this article, we will discuss every way that a late payment can be reported to a credit bureau and the typical timelines.

Key Takeaways: Missed Payments on Credit Report

| 14 Day Grace Period | You have a 14-day window to catch up on a missed payment before it may show as Arrears on your credit file. Pay within this time and no harm is done. |

| How Long Will I Be Affected | If reported, a late payment stays on your file for 2 years. A default is more serious and stays for 5 years. |

| Impact of Loan Eligibility | One isolated late payment usually won’t be a big problem. A pattern of missed payments will tank your credit score and limit your options. |

| Borrower Notification | Lenders do not have to warn you when reporting a late payment. It is your responsibility to stay on top if it. |

Credit Reporting Agencies in Australia

There are three primary credit reporting agencies in Australia: Equifax, Experian, and illion.

Each compiles your credit data independently, and different lenders may report to one, two or all three.

That means your credit score may vary slightly depending on the bureau used. It all depends on your lender’s level of participation in the system.

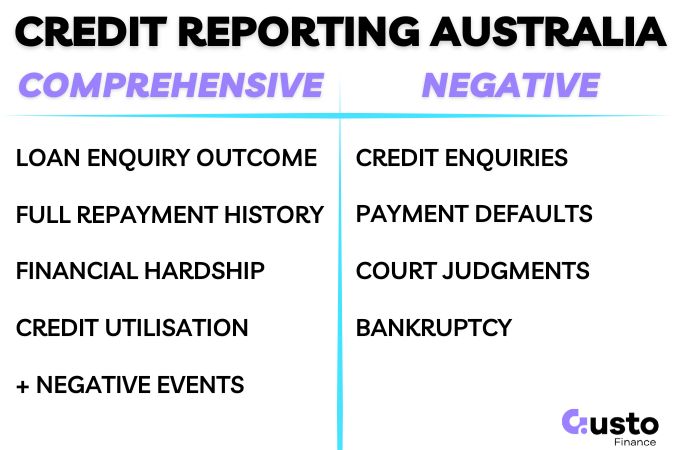

To complicate things further, there are two different systems operating in Australia:

Negative Credit Reporting

This is the legacy credit reporting system in Australia that has been in place since the late 80’s.

The credit information provided is limited to:

- Credit enquiries, including the date and amount applied for. No information on whether the application was approved or declined.

- Negative credit events such as default listings, court judgments, and bankruptcy.

Negative credit events can be updated where an account has been settled for a reduced amount or paid in full.

The threshold for reporting a negative credit event is much higher, and a late payment can go under the radar for much longer.

Comprehensive Credit Reporting (CCR)

The CCR system includes all of the negative credit event data discussed above, plus periodic reporting of the status of all current open loans.

As a result, an account in arrears could be visible on your credit file after that initial 14 days if not corrected.

While it is not intended to be a negative credit event, a temporary hardship agreement will also be visible in your account history for 12 months.

While this is a superior system, it has only existed since 2014, and participation is not compulsory among non-bank lenders.

So it does not yet represent the whole credit system.

To summarise the additional credit information under the CCR system:

- The outcome of credit enquiries (if they have led to an open loan).

- Current status of all open loans (whether they are up to date or in arrears).

- If a Hardship arrangement has been implemented, then this will be visible for 12 months.

Timeline of a Late Payment

A late payment cannot be reported to a credit bureau under the negative credit reporting system.

There will be no visibility of arrears on an account until a formal default is listed. This cannot be done for at least 60 days.

For the purpose of this section, a late payment is referring to the point where an account status would be updated to being in arrears under the CCR system.

How Long Before a Missed Payment is Reported?

The credit bureaus have a built-in grace period of 14 days before a missed payment can be reported on your credit file.

If you catch up on the payment before that 14-day window closes, you’re generally in the clear.

When Lenders Notify Credit Reporting Agencies

Lenders typically send updated credit data to agencies once a month. If your payment was late but caught up quickly, there’s a chance it won’t be reported.

However, if it remains overdue into the next reporting cycle, then the credit bureau will be notified.

After which, the missed payment will be evident on your credit file for the next two years and your credit score will probably take a hit.

How Lenders Treat Different Levels of Late Payments

One-off Missed Payment

If you have missed one payment and corrected the issue quickly, then the impact is going to be minimal.

You should retain access to plenty of lenders next time you apply for a car loan.

Multiple Missed Payments

Once a pattern emerges of regular missed payments, then this is going to be far more restrictive in the future.

Your choice of lender will be narrower, and there may be additional requests for information as part of a loan assessment.

Lenders may want to see evidence that you are not currently in arrears, and potentially 90 days’ worth of bank statements so that they can assess your financial habits and capacity.

Any sign that you are at risk of financial hardship if you are approved for this loan and you will be declined.

What is the Difference Between Default Listings and Late Payments

A default listing is a more serious mark on your credit file with longer-lasting consequences when compared to a late payment.

Those with a negative credit file only will have avoided any evidence of their arrears up until the point of a default listing, which can appear on both negative and CCR credit files.

When Does a Late Payment Become a Default?

If your late payments are left outstanding, then a default can occur after 60 days or more.

Your lender will have made attempts to contact you to resolve the problem and will also have sent notices of their intention to list a default.

If you do not repay the missed payment, then you will have a formal default listed on your credit file.

Notification Requirements

Lenders are not obligated to notify you before reporting standard late payments.

So it is important to be proactive if you think you may have missed a payment so you are not surprised by a listing one day in the future.

If your lender plans to default you, then they must issue a written notice and give you at least 30 days to rectify the issue.

The Consequences of a Default on Your Credit Report

A default will stay on your file for five years, compared to just two years for a missed payment.

Once you pay the debt, the status of the default will be updated to reflect this, but the mark will remain.

Your credit score will take a more significant hit, which can limit your access to further credit and increase your borrowing costs.

Some lenders may automatically decline applications from anyone with a default, regardless of circumstances.

However, there are lenders who specialise in these types of bad credit loans but it is important to know where to apply based on your individual circumstances.

Get in touch with our brokers below for a free consultation.

How to Fix a Late Payment Listing

You may be able to challenge a late payment listing if there has been some kind of process error, and you can show why a listing is erroneous.

However, given that there is no requirement for a lender to notify you of the intention to list then it can be difficult to do.

Prevention is much easier than the cure in this case so make sure you are checking your bank statements regularly and have notifications setup for when a payment fails so you can take immediate action.

Protect Your Credit Report

Lenders like to see a history of prudent management of your repayments. If you miss one, then it is your responsibility to correct the issue as quickly as you can.

You may also be charged additional interest on any arrears amount, and your bank probably slugged you with a payment reversal fee too.

Most lenders send payment reminder notices if you miss a payment, but there is no obligation to provide you with any specific notice before that late payment can appear on your credit file.

So it is in your best interests to always maintain an awareness of your repayment activities.