Car loan serviceability is an assessment your lender will make to determine if you can afford the repayments on your car loan.

There are hidden elements to this calculation that can significantly affect the outcome, and it varies from lender to lender.

There are also regulations that could see your expenses calculated at a much higher level than they actually are, to limit the risk of financial stress.

In this article, we will discuss the variables in the serviceability calculation that go beyond your own financial records, so you don’t get caught out.

Key Takeaways: Affordability Assessment

| Loan Affordability | Lenders calculate if you can service the loan after applying based on your financial information, and some additional buffers to reduce risk. |

| Assessed Living Expense | If your expenses are low, lenders may use a minimum expense benchmark instead of your actual expenses. Reducing your uncommitted income. |

| Income Shading | Not all income is equal. Lenders may only accept a portion of your overtime, bonuses, or casual income when calculating your capacity. |

| Affect of Credit Card Limits | Even if the balance is $0, Lenders will use 3%-4% of the credit limit as an estimated repayment amount, reducing your uncommitted income. |

How Lenders Calculate Car Loan Serviceability

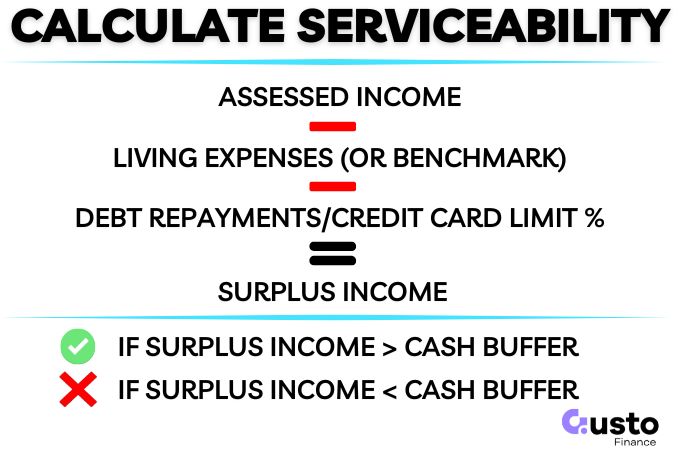

A serviceability calculation must determine if your income can comfortably cover loan repayments after all your living costs and existing debts are paid.

All three of these components have variables that can distort the outcome if they are poorly presented.

Income Calculation

Lenders need to consider both the amount you are earning, and the stability of that income.

This is easy for those with a full time job and a set salary.

Where it gets complicated is when you also earn bonuses, over time, or work casual hours with variances in your take home pay week to week.

Some lenders will consider 100% of your bonus income if you have earned them consistently for a period of time, whereas another may only count 50%.

Some lenders may use your lowest earning period as your baseline earnings for a casual employee, some may use an average over a longer period of time.

This is why it is so important to use a broker so they can assess your specific circumstances and match you a lender who will assess your income most favourably.

Expense Calculation

All applications will require you to estimate your expenses and there are two ways this information will be used.

The first is for those with a good credit score.

Your estimated expenses will be compared to a benchmark for what someone in your situation should be spending, and the higher of the two is used.

This is one reason why your expenses could be inflated compared to reality for the purposes of the loan assessment.

The second is for someone with bad credit.

Below a certain threshold you will also have to provide 90 days-worth of bank statements.

This allows the lender to scrape that data and calculate exactly what you are spending in that period.

You will still be required to estimate your living expenses, and both figures will be compared to a benchmark.

The higher of all three is most likely to be used in your assessment.

So, understating weekly costs rarely helps your application. But overstating them could hurt it.

Debt Repayments

If your existing debts have a fixed repayment amount then this calculation is straightforward.

For those with credit cards there will be more potential variation.

This is because your repayment is calculated as a percentage of your credit card limit, not the amount you owe.

The percentage can also vary between lenders, but is usually 3% to 4% of the limit.

So even if you owe $0, your unused credit limit will reduce your capacity to service your new car loan.

Cash Buffer

Most lenders will also add a buffer for what should be leftover in your budget after your car loan repayments are factored in.

This also varies depending on your circumstances and can be anywhere from $100 to $500.

If your cash surplus exceeds this amount then you pass this element of the credit assessment.

If you do not have enough uncommitted income to cover the cash buffer your application will be declined.

Once you consider all of this it is clear that your serviceability is not the same as your personal budget.

How to Improve Your Loan Serviceability

Calculate Your Debt Service Ratio (DSR)

Some lenders will also calculate a DSR as part of their serviceability assessment.

This metric measures your total monthly debt commitments against your net monthly income, showing the percentage of your earnings is already spoken for.

The formula is:

DSR (%) = (Total Monthly Debts ÷ Net Monthly Income) x 100

Here is a simple example for how to calculate a DSR:

- Net Monthly Income: $6,000

- Existing Debts: $900 (e.g., personal loan, credit cards)

- Proposed Car Repayment: $650

- Total Monthly Debt: $1,550 ($900 + $650)

Using the formula, the DSR is 25.8% ($1,550 ÷ $6,000 x 100).

While every lender has a different internal DSR cap, a lower number is always safer.

A higher ratio can signal financial over-commitment and potentially your application being rejected.

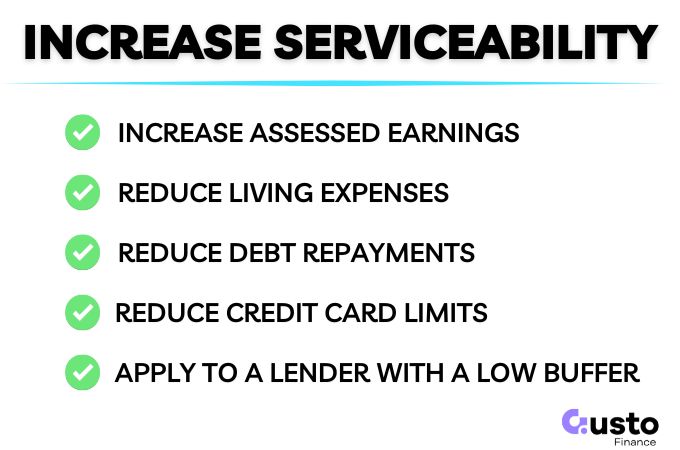

How to Improve Your Loan Serviceability

- Increase your included earnings.

- Reduce your living expenses.

- Reduce your debt repayments or credit card limits.

- Apply at a lender with the lowest buffer.

You can only cut your living expenses so far before you hit the benchmark expenditure floor.

There is far more benefit to come from reducing your debt repayments elsewhere or increasing your earnings.

Frequently Asked Questions

Do unused credit cards affect loan serviceability?

Yes. Most lenders assess a potential monthly repayment based on your total credit card limit, not your current balance. This is because you could max out the card at any time. Reducing the limits on cards you don’t use is a fast way to improve your serviceability.

What expenses do lenders look at for car loan serviceability?

Lenders assess all your regular living costs, including rent or mortgage payments, existing loan repayments, groceries, utilities, transport, and insurance. They also factor in costs for any dependants. If your declared expenses are below their benchmark minimum, they will use the higher benchmark figure.

I’m self-employed. how can I make my serviceability look clearer?

Two options here. The first is to apply for a low-doc loan through your business so your financial are not required. If you do not qualify, then a good practice is to keep your business and personal bank accounts separate to show clear personal income and expenses.

Can a broker improve my car loan serviceability?

A broker cannot change your income or expenses. However, they can significantly improve your approval chances by matching your profile to a lender whose policies are the best fit. They can also structure the loan term to meet your needs and the lender’s specific rules.

Get an Upfront Serviceability Assessment

One of the main benefits to using a broker is they can provide a full assessment of your options before a formal application.

Our team have access to the various benchmarks used by our lender panel, and can match you where you will get the best treatment for your circumstances.

If there are problems with your serviceability, or just ways to improve your application, it is best to address this early.