If you are self-employed or a business owner, then a low-doc loan is one of the best ways to get around the standard income documentation required when applying for a car loan.

You may not have payslips or regular PAYG deposits in your bank account.

So, how do you evidence that you do have an income? Well, in some cases you don’t have to!

In this article, we will discuss how the alternative pathway of a low-doc loan can answer this question and provide other advantages to your business.

Key Takeaways: Benefits of a Low-Doc Car Loan

| Who Qualifies for a Low-Doc Loan? | Self-employed sole traders and business owners (with an ABN) who can’t provide standard payslips or up-to-date tax returns. |

| Required Documents | In many cases, approval requires just your ID and ABN registration. |

| Fast Approval Times | Because lenders skip the complex analysis of tax returns, approvals can often be processed in minutes rather than days. |

| Immediate Ownership | Unlike a lease or hire, a Low Doc loan gives you immediate ownership of the vehicle, allowing you to claim tax benefits from day one. |

Who Qualifies for a Low Doc Loan?

A low-doc loan is most suitable for those with an ABN who would like to finance any type of vehicle that is mostly used for business purposes.

This could be a car, truck, or any other commercial vehicle.

The method of credit assessment is very different from that of a regular consumer car loan and allows the applicant to rely on business income documentation rather than traditional things like a payslip.

Self-employed and small business owners are often faced with roadblocks when trying to finance a car, and the low-doc loan can overcome these.

Documentation Required for a Low-Doc Car Loan

In some cases, you can qualify for a low-doc loan by simply providing your ID, ABN, and an invoice for the asset you plan to purchase.

And you could be approved within minutes!

In other cases, you may need to provide additional information, which may include a combination of the following items:

- ABN registration (minimum 1-day since registration, but most lenders require 6 months)

- GST Registration

- Business Activity Statements (BAS)

- Tax returns (up to two years)

- Evidence of cash to be used for a deposit

- Details of property owned

Not all of the above will be required on every application. It can vary a lot depending on your situation.

A broker can help you navigate this and ensure your application is squeaky clean before it is put to a lender.

To kick off this process, you can submit an enquiry below, and our team will be in touch.

7 Advantages of a Low-Doc Loan

1. Accessibility for Small Business Owners

For a business owner, access to finance is often more important than the cost of accessing that finance (within reason).

Yes, a low-doc loan is going to be more expensive than a regular consumer loan, but the opportunity the loan can create for a business can be far more significant.

Being able to access finance in an emergency could also save a business one day.

If you are a tradie who relies on your ute to get from job to job and your engine blows up, then fast access to finance could save your business.

2. Less Documentation Required to Apply

In most cases, a low-doc loan requires less paperwork than a standard loan – it’s all in the name!

If your financials are strong, then the documentation required could be as much as providing your ID.

For more difficult approvals, as long as you have basic financial records and have kept up with your taxes then you should be able to meet all requirements in no time.

3. Faster Approval

A combination of the simplified documentation and dealing with a specialised small businesss credit assessment team means faster approval times.

We often receive low-doc approvals in minutes. Much faster than a standard consumer car loan!

Time is money and the speed to a final outcome can be a huge advantage for you.

4. Vehicle Ownership

Alternative finance options for a business owner are hire purchase agreements and leasing.

Neither of these options includes ownership of the asset when you enter into the agreement.

With a low-doc loan, you own the vehicle on day one!

5. Tax Advantages

If you own the vehicle, then things like depreciation could be claimed as a business expense in most circumstances.

There is a range of other expenses and tax credits that you can take advantage of when you take out a low-doc loan.

Speak to a tax professional before entering into an agreement so that you understand all of tax advantages available to you.

6. Flexible Use of Funds

A low-doc loan can be used to purchase a range of commercial vehicles relevant to your business.

Cars, vans, trucks, and a range of commercial vehicles could all be purchased with a low-doc loan.

We also see recreational vehicles such as caravans and boats financed in this manner. It all depends on your business activities.

A low-doc loan can also be used to refinance out of other existing loans or to finance a balloon payment.

7. Less Frustration for Business Owners

If you have ever applied for a regular loan as a business owner, you will know the constant back & forth with a lender who just doesn’t understand how your business works.

Lots of time wasted, and lots of dead ends!

When you apply for a low-doc loan, your application will be in front of someone who specialises in small business lending.

If everyone is speaking the same language, then it makes the whole process much easier.

You can further limit your time investment by letting a broker handle things on your behalf. We have a working relationship with our panel of lenders and can problem-solve issues that come up with a more complex business loan application.

Allowing you to get back to business faster and do what you do best!

Get in touch below to kick things off today!

Convenience with Limited Cost

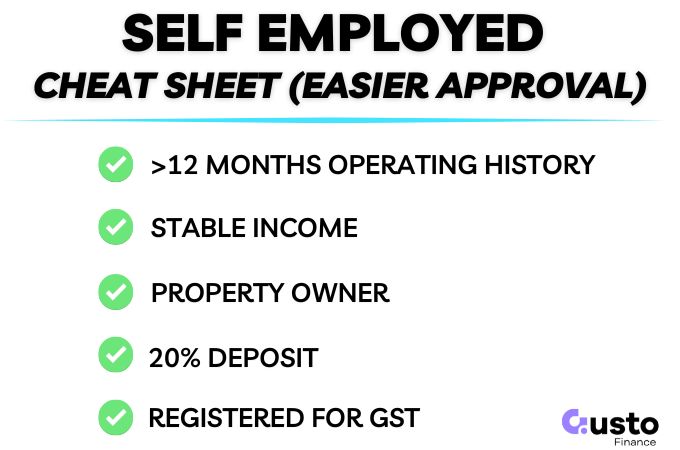

Despite the lack of financial documentation required, low-doc loans often come with very competitive interest rates!

Assuming you have decent credit and a solid operating history, there should be limited downside compared to a full-doc loan.

If you have poor credit, and hold no property, then you may have to cop a higher rate for the convenience.

But you have a business to run, and the opportunity cost of not having that vehicle can be far more significant.

What is a few percentage points in extra interest if you can get another truck on the road generating income for your business?

The benefits far outweigh this cost for any healthy business and there are plenty of other advantages when taking out a low-doc loan.

If you need help finding a great deal on a low-doc loan then speak to the team at Gusto Finance.

We have access to over 40 lenders and can match you with the best low-doc lender for your situation today.