Vehicle financing usually requires the asset being purchased to be used as collateral for the loan.

The lender registers a security interest in the vehicle, and if the loan is not repaid as agreed, it could be repossessed and sold to recover the borrowed funds. This protects the lender from potential losses.

As a result, they can offer cheaper interest rates on the loan.

This formula doesn’t change if the car is new or used. However, the difference in the quality of the asset does influence the type of loan available to finance that vehicle.

In this article, we will compare new and used car loans so you know what is most suitable for your circumstances.

Key Takeaways: Used vs New Car Loan

| Interest Rates | New car loans typically have lower interest rates because the vehicle is newer and has no uncertainty on the value of the asset held as security. |

| Loan Amount and Terms | Lenders are more comfortable with higher loan amounts, and longer repayment terms, on a new car due to the longer expected useful life of the asset. |

| Asset Age Limits | Lenders often have strict age limits for used cars for them to qualify to be held as security. New cars have no such restrictions. |

| Warranty & Risk | New cars come with a manufacturer’s warranty, reducing the risk of expensive repair bills. A used car may come with a short warranty if bought through a dealership. |

Why the Age of the Secured Asset Changes the Loan

A better quality asset means a larger resale market, which in turn lowers the risk for the lender.

This is the key driver of the different pricing and conditions that a lender may place on the two loan categories

New Car Loans: Lower Rates & Longer Terms

Every year, there are over 1 million new cars sold in Australia. The majority are sold by only ~50 manufacturers who sell thousands of the same vehicles each year.

There is a standard retail price set by the manufacturer for each model so the value is uniform at the time of financing.

The only exception is when modifications are made to the standard features of a new car prior to purchase.

A lender knows exactly what they are financing when funding a new car purchase and carries the lowest risk.

Used Car Loans: Higher Risk & Stricter Rules

The quality of a used car is far less predictable than a new car and is heavily dependent on how it has been used and how well it has been maintained over its lifetime.

What if there are scratches and dents on the vehicle? This would affect the resale value of a car.

A lender will not inspect individual vehicles when deciding whether to approve a used car loan or not.

They must make a standardised judgment on a non-standardised asset class.

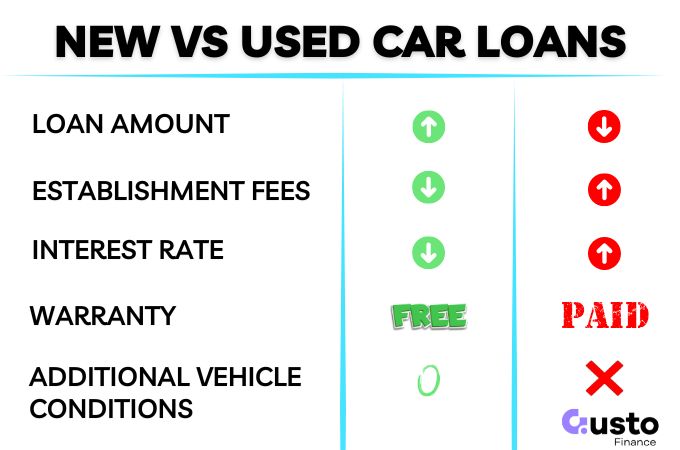

Used vs New Car Loans

This comparison is not to determine which loan type is better, but to highlight the differences in each relevant area that is influenced by the asset type.

A new car loan is better in every aspect! But only if you can afford the larger loan and higher repayments.

Loan Amount

A new car purchase is generally higher than what you pay for a used car. This is obviously dependent on what you are buying, but on average, this is the case.

Lenders are more comfortable with a larger loan size when secured against a new car due to the longer remaining useful life of the car, and an easier resale market.

A larger loan means higher repayments. So to qualify, you will need a higher income, which would also mean a lower credit risk, assuming all other factors are equal.

Used car loans are capped at a lower maximum level. The resale value of the vehicle is less certain, and the market potentially smaller.

Establishment Fees

Used car loans can often attract larger establishment fees than a new car loan.

If a customer has a lower credit score or income, they may also attract a risk fee as part of the loan offer.

Depending on the credit profile of the customer and the vehicle type, these fees can add up to $2,000-$3,000.

A new car may attract a smaller establishment fee of a few hundred dollars.

New vs Used Car Interest Rates

We have spoken a lot about risk so far in this article, and the outcome of a lender’s risk assessment is what determines the interest rate.

All lenders will have tiers of interest rates that will be assigned based on a combination of:

- The creditworthiness of the customer.

- The type and value of the vehicle being financed.

As we have discussed at length, a new vehicle is a lower risk asset to a lender than an older used car.

Vehicle Warranty

All manufacturers offer some kind of warranty with their new car sales. Some even throw in some free or low-cost servicing early on as a sweetener.

Some used cars may still benefit from the original warranty if they are still within that timeframe, but an older car will not.

If the used car is bought through a licensed dealership, then the standard three-month statutory warranty will apply.

However, you can purchase warranty coverage with your used car as part of your financing package.

The cost can range from $500 up to $1,500, depending on what is included and the length of time you would like the coverage.

These are best assessed on a case-by-case basis. Speak to the brokers at Gusto Finance to learn more.

Source of Vehicle (Dealer or Private Sale)

That statutory warranty can give lenders at least some comfort that the vehicle being sold is mechanically sound.

As a result, lenders may impose conditions with a loan approval that require the financed vehicle to be purchased from a licensed dealership.

This can be an inconvenience for some, but overall removes some of the risk of buying a lemon.

Age of Vehicle

Another common condition that comes with a used car loan approval is limitations on the age of the car being financed.

The additional catch is that the age is sometimes assessed at the end of the loan term, and not the date of purchase.

A new car comes with no such conditions because they have a long useful life ahead.

Valuation of the Vehicle

Lastly, I wanted to talk about loan-to-value ratios (LVR).

Most only ever hear this term when taking out a mortgage. Well, the same measure applies to car loans just with very different thresholds.

A used car loan can have a maximum LVR of ~180%.

Sounds very high, right? But if you choose to roll in additional costs like insurances into your loan, then it can creep up very fast!

Let’s look at an example:

- Purchase price: $8,000

- Establishment fees: $1,000

- Risk Fee: $750

- Broker Fee: $550

- Insurance: $1,000

- Warranty: $500

Let’s assume the assessed value of the car is $8,000 (it could be different in some circumstances). The LVR is now 147.5%.

If we compare this to a new car example, then you’ll quickly see how different the figures are:

- Purchase price: $40,000

- Establishment fees: $450

- Risk Fee: $0

- Broker Fee: $1,250

- Insurance: $2,000

- Warranty: $0

The assessed value will match the sale price of a new car, which places the LVR at 109.25%. Which is never going to spook a lender and put your loan approval in doubt.

Conclusion

New car loans will generally come with lower interest rates, higher credit limits, and lower fees.

But it will only be available to those who can afford the higher repayments and have decent credit.

There are still plenty of great used car finance deals out there! This is where a broker is worth their weight in gold.

Our team of experts can match you with the right lender for your situation, whether that is for something shiny and new, or well well-selected used car.

Get in touch by submitting an enquiry below.