While most people don’t know it, Australia has undertaken a huge transition in the credit system over the last decade.

Prior to 2014, a credit file could only ever report on enquiries and significant credit events (like a default).

This has now changed with credit scores now a more comprehensive reflection of your borrowing history. However, the legacy systems still exist and are used by many non-bank lenders.

As a result, there is no one credit score in Australia. In this article, we will discuss the difference and what the minimums are if you are applying for a car loan.

Key Takeaways: What Credit Score Do I Need?

| Is There a Minimum Score? | Technically there is no minimum. However, your choice of lenders will severely diminish when you fall below 400. |

| Ideal Credit Score for a Car Loan | As long as you have a score >650 then you will qualify with a number of good quality lenders, subject to your overall credit profile. |

| Auto Lenders Rate for Risk | The lower your credit score the higher the interest rate you should expect to pay. Sub-prime rates are often in the 20%-30% range. |

| Protect Your Score | Avoid making multiple loan inquiries in a short time. Check your eligibility with a broker first to minimise applications. |

Australia’s Credit Reporting System

What is a Credit Score

A credit score is a calculation that forecasts the likelihood of you defaulting on a credit obligation in the future.

A higher credit score means you are less likely to default, and lower risk to a potential lender.

However, this is a snapshot in time based on the data collected by a credit bureau.

So, there are limitations on its conclusiveness, and it will only form part of a lender’s decision to approve or decline your loan application.

Who are the Credit Bureaus

There are three major credit bureaus in Australia: Equifax, Experian, and Illion.

All three have their own methods for data collection and calculating a credit score.

It is also worth noting that Experian acquired Illion in 2024.

They still operate as separate Bureaus at the time of writing, but the methodologies used may converge over time.

Within the credit bureaus, there are multiple reporting systems in operation as a result of this transition still being underway.

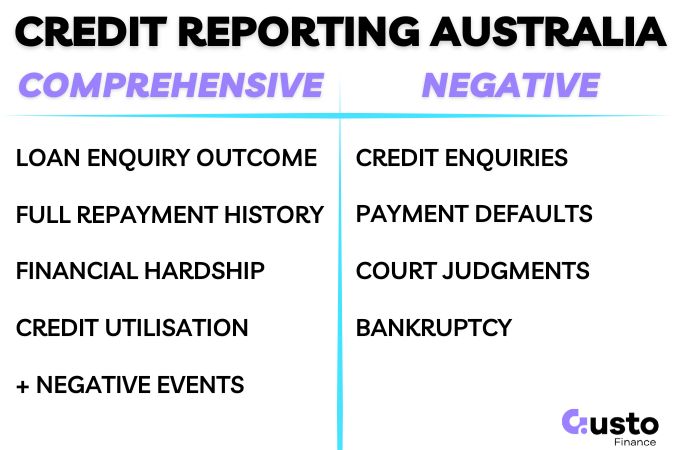

Negative Credit Score

Negative credit reporting is the legacy system that supported consumer lending throughout the 90s and early 00’s.

While still in operation, it is slowly being phased out as more lenders join the Comprehensive Credit Reporting regime.

A reportable event under the negative credit system would be a loan enquiry (with no information on whether that enquiry led to an approved loan), a payment default, a credit-related judgment, and a bankruptcy event.

There are a lot of blind spots under this system that can both hurt and help borrowers access credit, depending on the circumstances.

Comprehensive Credit Score (CCR)

A comprehensive credit report includes more complete data on enquiries and if they led to an open loan, full repayment histories of the open loans, and credit utilisation levels on accounts like a credit card.

All of the negative credit events are also reported, and from 2021 all financial hardship agreements are also reported.

This all leads to a much more comprehensive data set as the basis of the credit score and a more accurate prediction. Allowing lenders to approve more customers wth greater certainty.

While this is a great system, participation is not compulsory for all lenders.

Which means you may be shortchanged if you have had bad credit in the past and apply directly to a lender who only uses the negative system.

This is why it is helpful to use a broker so they can place you with a lender most likely to approve your loan. Hit the button below to get started.

Credit Score Required for a Car Loan

The information below is a guide only. A credit score does not guarantee eligibility for the loan you want – a lender will consider a range of factors in addition to the credit score.

However, a good credit score is the first hurdle to qualify for some of the best car loan rates on the market.

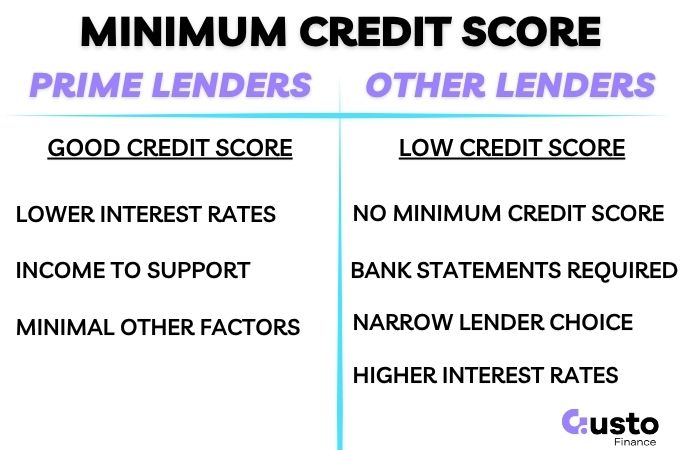

Minimum Credit Score for a Car Loan

There is no minimum credit score required to qualify for a car loan with a small number of non-bank lenders.

If you have a very low credit score, then other factors can be much more influential when assessing your loan application.

Your bank transaction data, whether you have a deposit, the type of credit you have engaged with over the past 24 months, are things that could help your application.

However, your choice of lender will be limited, and your interest rate will be much higher than if you had a high credit score.

So, what is a good credit score?

Credit Score Ranges

The ranges below are based on the Equifax CCR scores. This is the most common credit score used amongst our panel of lenders.

As a rough guide, you are likely eligible for a car loan if you are in any of these categories. The loan will have a higher rate in the lower credit score bandings:

- Very Bad Credit – <200

- Bad credit – 200 to 400

- Fair credit – 400 to 600

- Good – 600 to 800

- Very good – 800+

A slightly different scale will apply at a lender that does not participate in Comprehensive Credit reporting.

However, the difference is marginal in terms of the score itself. Where the difference matters is in the data processed and the calculation methods that produce the number.

So if you were to compare your own comprehensive score to your negative score, the number may be very different and it could impact your car loan eligibility.

How Your Score Impacts Your Interest Rate

You can get A car loan with a very low credit score. And if that is the criteria, then there is no minimum score required. But only a few lenders think this way.

If you want the BEST products on the market, then you need a high credit score to be eligible.

Accessing the best rates on the market is also dependent on other factors such as your income and whether you own property or not.

And with interest rates falling in Australia, you can now get car loan rates as low as 5%-7% if you have a great credit score.

At the lower end, if you have poor credit, then you may be paying a rate upwards of 25%.

If you would like to know your credit score BEFORE applying for a car loan (and potentially doing more damage to your credit score), then get in touch with our expert team below for a free consultation.

Can I Get a Loan with a Bad Credit Score?

Yes, you can get a car loan with bad credit as long as you can demonstrate other positive financial behaviours.

Demonstrated savings, or a cash surplus at the end of each pay cycle, is a strong sign that you are back on track after some past issues.

However, you will be required to pay a much higher interest rate until you can improve your credit score.

Check Your Score Before You Apply

The move towards comprehensive credit is a positive for borrowers who can demonstrate good habits over time.

As you build up a history of borrowing and repaying your loans on time, you will be able to access cheaper products, which can create opportunity.

It is harder for bad actors to hide when all of their financial behaviour is assessed as part of a loan application.

And the less bad debt that a lender incurs in their activities, the better the system works for all Australians.

So while there is no minimum credit score to be approved for a car loan, it does play a big role in your eligibility with certain lenders.

The more lenders you have to choose from, the better the outcome for your personal finances.