When applying for a business car loan, a low-doc loan is almost always the better option.

They require very little paperwork, no detailed financials, and can be approved in minutes.

However, there is eligibility criteria to access this accelerated pathway to a loan approval.

If you are a new business, have had credit problems in the past, or are buying a bigger ticket asset, you may be required to go down the full-doc pathway.

In this article, we will compare full-doc and low-doc loans, looking at documents, rates, and approval speeds.

Key Takeaways: Full Doc vs Low Doc Loans

| Difference Between Low and Full Doc | Low Doc loans only require an ABN registration and an ID to be eligible to apply. Full Doc loans require more in-depth financials of the business. |

| Eligibility Criteria | Low Doc loans have very simple criteria for ABN registration and credit score, full doc is much more flexible and dependent on overall business health. |

| Speed to Approval | Low Doc loans are often approved faster (in minutes!) because the lender doesn’t need to analyse complex financial statements. |

| Maximum Loan Amount | Limits on low-docs are very high (up to ~$400k possible), whereas there is no limit on a full doc and is borrower and lender dependent. |

Commercial Loan Application Processes

Lenders have a lot of flexibility with commercial loans compared to regular consumer finance.

These loans are not subject to the same regulations and consumer protection mechanisms and a lender can act in their own best interest when assessing a loan.

They don’t want to lose money when making a loan, but also need to be efficient.

This means streamlining their assessment processes when they deem the risk tolerable.

As a result, there are multiple application pathways available to ABN holders and business owners.

Low-Documentation Loan Application (Low-Doc)

A low-doc loan application is intended to be low friction for the borrower and lightning fast for the lender to approve.

As long as you meet some basic criteria you are deemed low risk and can be approved in minutes.

This allows business owners to direct their time back into their company rather than digging up various paperwork required for a more comprehensive loan assessment.

Full-Documentation Loan Application (Full-Doc)

A full-doc loan is more of a standard lending product where detailed business financials are submitted for assessment.

This can mean business activity statements, bank statements, and a range of other potential documents.

This allows the lender to conduct a comprehensive review of the business before approving or declining a loan application.

Both methods serve an important purpose in providing access to finance for business owners.

If you are unsure what is more suitable for your circumstances then click below to get in touch with our team of expert brokers.

They will help you access the best option.

Low Doc vs Full Doc Vehicle Loans

Below we will compare each type of loan on the 8 most influential factors when finding the best finance solution for you.

1. Required Paperwork

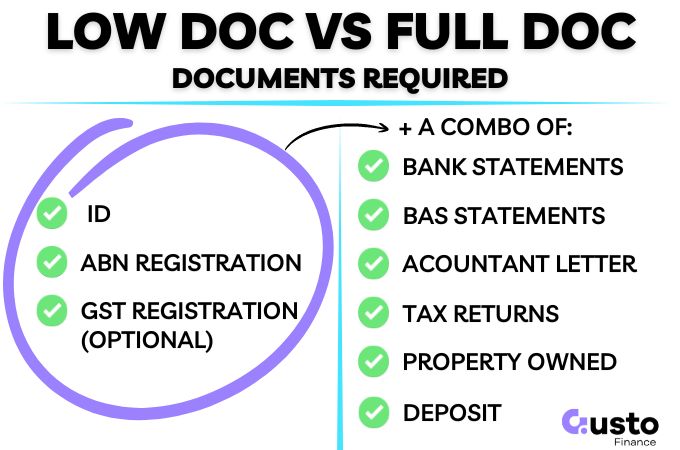

The main difference between these loans is the supporting documentation you must provide with your loan application.

A low doc car loan requires the following documents:

- Personal ID

- ABN Registration

A GST registration can also strengthen your application and help you access a higher maximum loan amount, but it’s not essential.

Gathering these documents would take just a few minutes.

A full doc loan has a much more extensive list of documents, and a combination of the following list could be required depending on your circumstances.

- ABN registration

- GST registration

- Accountant letter

- Business Activity Statements

- Up to 6 months of business financials

- Tax returns (up to two years)

- Evidence of cash to be used for a deposit

- Details of property owned

2. Eligibility Thresholds

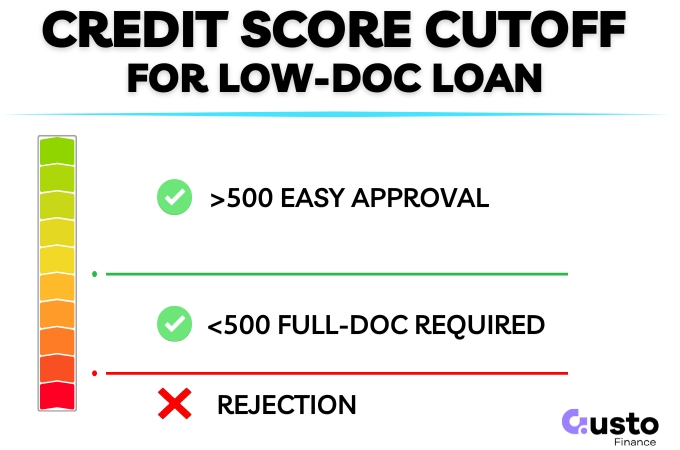

Low-doc loans have a short, list of eligibility criteria:

- ABN Registration >6 months ago (1 day possible for some trades)

- Credit Score > 500

There is flexibility on these if you own property, or can demonstrate other characteristics that lower your risk profile.

Any adverse credit listings could also make you ineligible for a low-doc loan, even with a higher credit score.

While these are not black & white rules, if you fall short of either of these then you may have to go down the full-doc pathway.

The outcome of a full doc loan assessment is dependent on the overall health of the business, and a broad range of borrowers can be accommodated.

There may be no ABN registration period, or credit score related cutoff, if the business or directors own property with significant equity.

Anything is possible in commercial finance if the risk of the deal stacks up for the lender.

3. Interest Rates and Risk Based Pricing

Even if you qualify for a low doc loan based on the above criteria, there are additional factors that can help you secure the lowest interest rate possible.

The two most important are:

- Whether you are a property owner.

- Whether you be paying a deposit towards the vehicle

A property owner with a 20% deposit will get the best deal possible on a low-doc car loan.

While the complexity of the loan assessment is much deeper for a full-doc loan, the concept is the same.

The higher the risk of the loan, the higher the interest rate will be.

For those who are applying with a lower credit score, an interest rate in the teens or even 20%+ is possible unless there are significant factors to offset this.

4. Deposit Requirements

An application for either loan product is strengthened if a deposit will be contributed by the borrower.

A smaller loan amount vs the value of the vehicle lowers the risk for the lender and this can help secure an approval, and potentially a better rate.

This is another factor that can be influenced by whether the borrower is property backed or not.

No deposit options are available for both full doc and low doc loan options in some circumstances.

5. Fees & Interest Rates

The cost structure for any commercial finance deal is uncertain until the assessment has been completed.

This is true of both low doc and full doc loans.

Lenders will assess the risk involved and apply what they deem an appropriate interest rate and fee structure.

The fees can be much higher than a regular consumer loan, which is subject to legislated annual caps on the cost of finance.

It is difficult to provide guidance on this due to the large variance between deals, and the long list of variables that influence the outcome.

Exit fees are also very high on commercial finance deals if you want to repay the loan early.

6. Approval Speed and Predictability

The simplicity of a low doc application means there is not much to review, and not much that can derail your application.

It is very much a pass/fail proposition and any competent broker should spot any issues well before they are put in front of a lender.

The depth of documentation in a full doc is a double edged sword.

A seemingly good application could be destroyed by a detail found while scrutinising financial documents.

Or, it could strengthen the application of someone with bad credit if the business financials are now in excellent shape.

An unavoidable outcome of both scenarios is that an assessment will take time.

Instead of minutes like a low doc, it could be hours, or days to conclude on a full doc car loan assessment.

A well-prepared application from a broker can help bypass a lot of frustrating back-and-forth that can happen through this process.

7. Loan Amounts and Repayment Terms

Both loan types can run for up to 7 years, so no difference there.

However, a low doc loan can run up to $400,000 (and beyond) if the deal stacks up for the lender.

This is fine for most light commercial vehicles, but if you want to purchase a heavier vehicle it may not be sufficient.

There is no limit on commercial finance loans. A full doc loan could run into the millions of dollars for a fleet of vans, trucks, or machinery.

It all depends on the financial health of the business, and matching with the right lender for their needs.

8. Balloon Payments

Balloon payments are available under both loan structures which can provide great flexibility for a business owner wanting to preserve cash flow.

If the business can generate a greater return from retaining that cash flow than the cost of the loan then this structure makes good financial sense.

What Vehicle Loan Structure is Best for my Business?

For most business owners the answer is whatever gets the best result in the least amount of time.

The answer starts with what assets you are trying to buy, what loan you qualify for, and what lender you are best placed to secure the cheapest outcome.

If available, a low doc loan is often the way to go.

Rarely will the full doc option be much cheaper for a good quality business.

This option is best saved for assets that cannot be financed any other way, or when there are some question marks over the application that additional documents can solve.

Click below to check your eligibility and get an obligation free preliminary assessment, so you know if a low-doc or full-doc loan is best for your business.