A low-doc loan requires less paperwork than a standard car loan – it’s all in the name!

If you are asset-backed and have a deposit, then you may not need any financials at all!

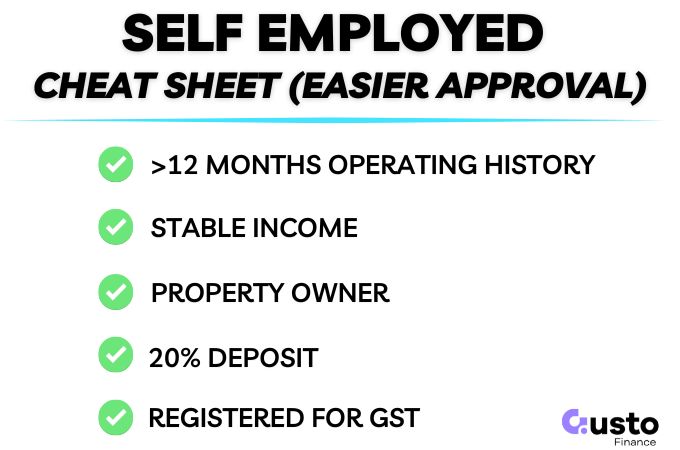

While not every loan will be as straightforward, this is your starting point with a low-doc car loan.

Key Takeaways: Low-Doc Loan Checklist

| Minimum Documentation Required | All you need is Proof of ID (Driver’s License) a valid ABN. Confirmation of GST registration can also be helpful. |

| Property Ownership | Being a property owner can fast track you to a Low-Doc approval. |

| ABN Registration Period | Most lenders require 6+ months and is GST registered. However, some lenders accept 1 day ABNs. |

| Is a Deposit Required? | A 20% deposit can help you get fast approval and the best rates available, but is not usually required to qualify for a low-doc loan. |

Who Can Apply for a Low Doc Car Loan

A low-doc loan is targeted towards business owners who are unable to evidence income in the same way as a PAYG employee.

The lender can instead accept alternative documentation to evidence the borrower’s capacity to repay the car loan.

There is additional flexibility due to the loan being a commercial deal and not subject to the same Responsible Lending regulations as a regular consumer car loan.

So, you must be operating a business to be eligible for a low-doc loan. This can include:

- Self-employed ABN holders

- Small business owners

- Company directors

What Documents Do I Need for a Low Doc Car Loan

There are only a couple of things that are required for every low-doc car loan.

Without exception, you will be required to provide:

- Proof of ID; and,

- ABN Registration

Your ABN registration will only need to be registered for a single day to be eligible with some lenders. However, over 6 months will get you more options.

If you are registered for GST then you should also provide this (but it’s not always required).

The lender will have more confidence in your application, knowing the business is turning over sufficient revenue to be over the GST threshold.

The only missing piece of the puzzle is the details of the vehicle you will be purchasing. In many cases, we secure a near-instant loan approval.

If this sounds good, then get in touch with our brokers below to kick off the process.

Other Potential Documents

Depending on your profile, you may also be required to provide additional information to meet a lender’s threshold to approve the loan.

If you were to provide all of the information below, then it would no longer be a low-doc loan. The list is intended to show what could be asked, not what is likely to be asked.

We frequently secure loan approvals for our customers with one or none of these items as part of a low-doc car loan application.

Other documentation that could be requested may include:

- Proof of property ownership (e.g. a rates notice)

- Business Activity Statements

- Up to 6 months of business financials

- Tax returns (up to two years)

- Accountant’s letter

- Evidence of cash to be used for a deposit

Difference Between Low Doc and Full Doc Car Loans

A full doc car loan would require most of the information in the list above.

This enables the lender to conduct a far more in-depth assessment of your business financials.

However, this can be time-consuming compared to the low-doc option.

It is only warranted for very large business loans, more complex financial arrangements, or if the lender spots a red flag that warrants additional scrutiny.

A poor credit history, for example.

In most cases, a low-doc loan will produce a suitable outcome for the business owner if they are only seeking a new vehicle or two.

This avoids all scrutiny of financials and means there is no minimum income required. However, the GST registration implies that income is at least above the threshold.

Get Approved with Minimal Documents Needed

You can further improve your chances of a fast approval if you have a reasonable deposit for the vehicle (20% is very healthy) and you are a property owner.

An approval can be achieved within minutes!

So there are a ton of advantages to a low-doc loan for ABN holders. The best part is that it doesn’t take much of your time if you partner with a good broker.

Our expert team is ready to help you land your next vehicle and expand your business. Click the button below to get in touch.